Arthur Hayes: Are We About to See a Stealth Money Printer Surge?

Arthur Hayes, co-founder of 100x and a notable crypto enthusiast, recently tackled the financial mess Japanese banks are in with his article "Shikata Ga Nai." Inspired by the phrase "it cannot be helped," Hayes links Japan's banking troubles to the inevitable surge in money printing, known as the "brrrr" of the money printer.

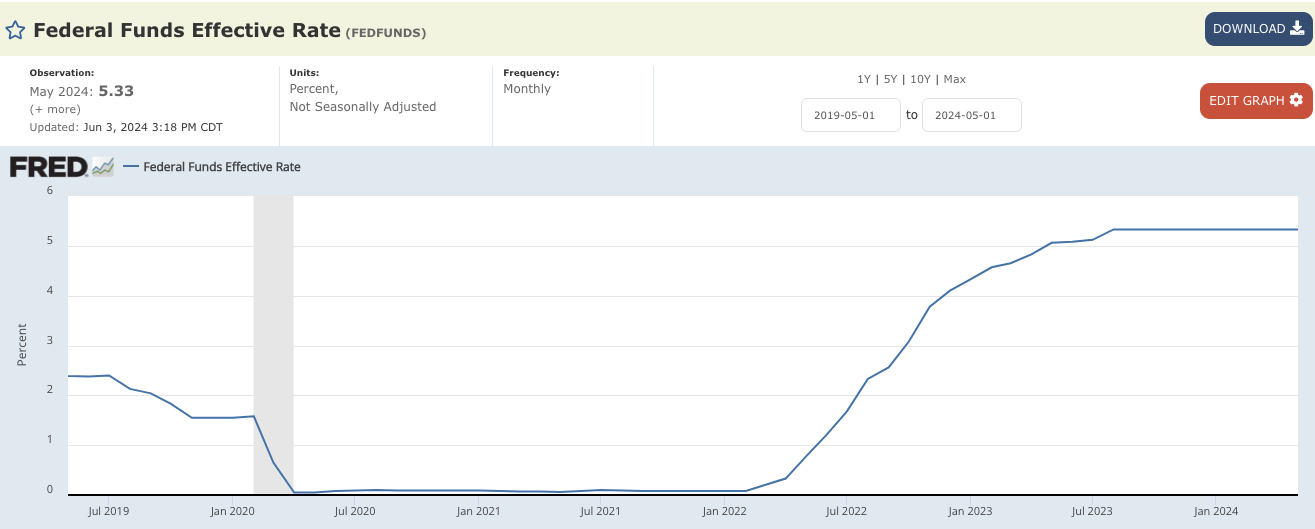

Japanese banks, trapped by low domestic yields, have long relied on the dollar-yen carry trade. They borrow yen at near-zero rates to invest in higher-yielding U.S. Treasury bonds (USTs). This once-profitable strategy has blown up in their faces with the Fed’s aggressive rate hikes to fight inflation.

With U.S. interest rates skyrocketing, UST values plummeted, leaving Japanese banks like Norinchukin Bank facing massive losses. Norinchukin recently announced plans to offload $63 billion in foreign bonds, mainly USTs, due to the costly currency hedging. This highlights the broader crisis for Japanese banks holding around $850 billion in foreign bonds.

Enter the Bank of Japan (BOJ) and the Fed's Foreign and International Monetary Authorities (FIMA) repo facility. To prevent a sell-off that would spike UST yields and disrupt global markets, the BOJ is likely to buy these bonds and use the FIMA repo facility. This allows central banks to pledge USTs in exchange for freshly printed dollars, increasing the global dollar supply.

This maneuver sidesteps the free market, preventing a bond market collapse from a sudden UST influx. However, it comes at a price: more dollars in circulation, fueling inflation—the hallmark of the "brrrr" scenario.

For the Fed, it's about stability. By providing liquidity to the BOJ, it ensures USTs aren't dumped, which would drive up yields and make U.S. borrowing more expensive. Yet, this also devalues the currency, leading to inflationary pressures.

In an election year, with high political stakes, Treasury Secretary Janet Yellen and the Fed will likely prioritize market stability over inflation concerns. This environment favors Bitcoin and other cryptocurrencies, which thrive on fiat currency weakness. As money printers go "brrrr," cryptocurrencies' scarcity and value proposition become more attractive, potentially driving prices higher.

In conclusion, the global financial system's interconnectedness means the Fed's actions to stabilize the bond market will lead to more money printing. This "brrrr" scenario, though unavoidable, exposes our financial system's fragility and the delicate balance central banks must maintain to ensure stability without triggering runaway inflation. Investors must stay vigilant, considering these monetary policies' impacts on their portfolios, especially in cryptocurrencies. Shikata ga nai—this cannot be helped.

-Benjamin